December 6, 2024 - 01:06

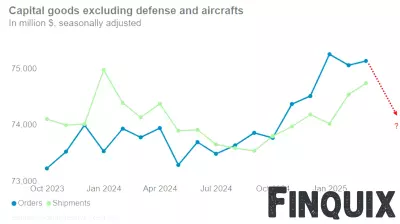

The holiday shopping season has seen a significant increase in the adoption of buy-now-pay-later (BNPL) services among American consumers. According to the CEO of Splitit, a prominent BNPL firm, their company experienced a remarkable 62% rise in order volumes during the week leading up to Cyber Monday. This surge highlights a growing trend as more shoppers opt for flexible payment options to manage their holiday expenditures.

As consumers face rising prices and economic uncertainty, the appeal of BNPL services has become more pronounced. Shoppers are increasingly seeking ways to spread out their payments while still enjoying the benefits of immediate purchases. This shift in consumer behavior is reshaping the retail landscape, with many retailers integrating BNPL options into their checkout processes to attract more customers.

The significant growth in order volumes for Splitit suggests that BNPL services are becoming a mainstream payment method, offering a convenient solution for those looking to balance their holiday spending without incurring credit card debt.